- What We Do

- Why We're Different

- Who We Are

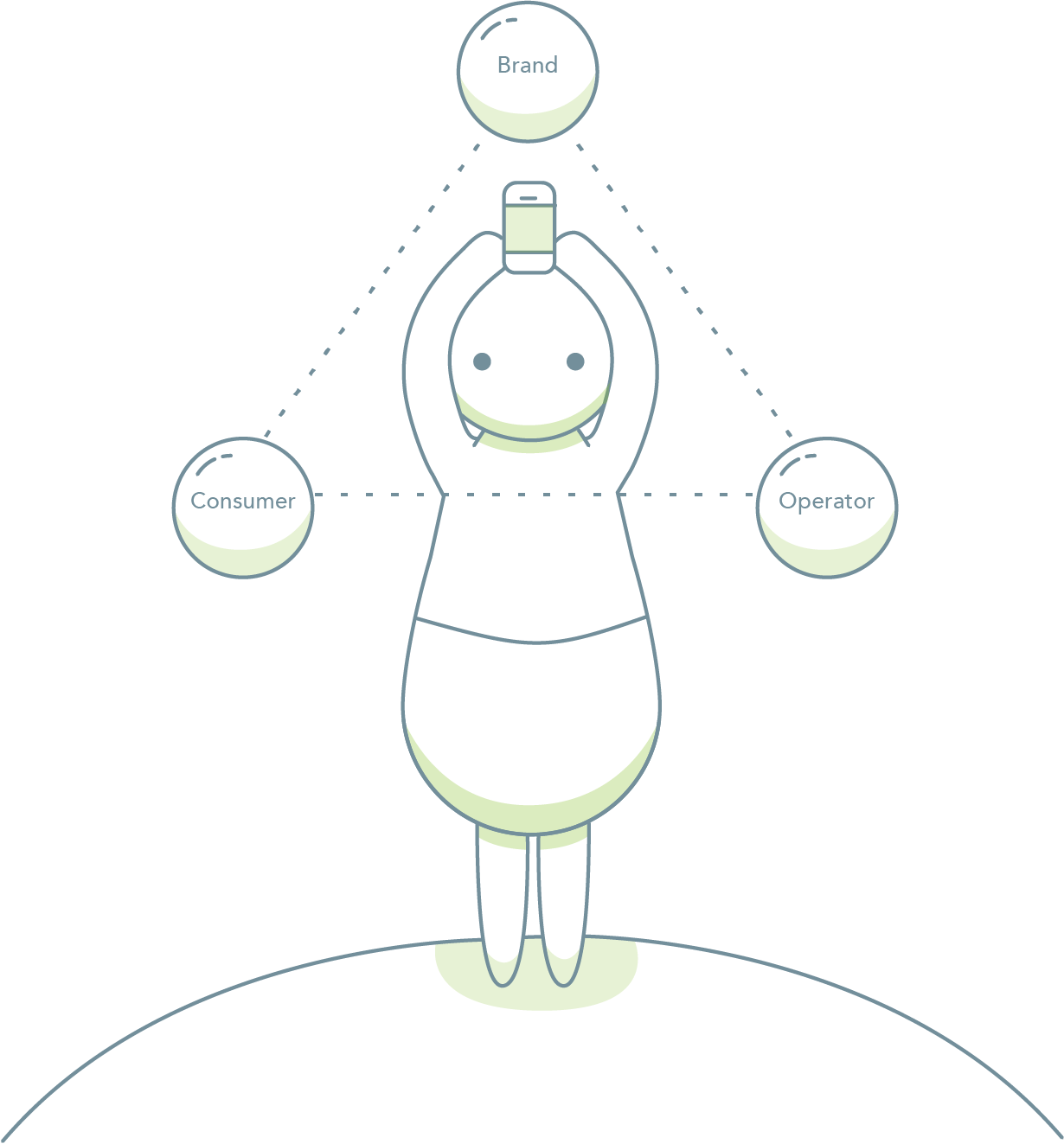

Datami enables enhanced mobile engagement for brands while allowing operators to scale their mobile marketing business, and consumers to access and earn mobile data. By combining real-time customer data from operators and brands with an unparalleled range of network-aware mobile marketing solutions, our platform delivers sharp increases in click-thru rates and in-app daily active usage and conversion.

We align the needs of brands, operators and consumers to deliver on our vision: Mobile data for everyone.

We have already developed close partnerships with tier-one operators across six continents, serving more than 1.3 billion consumers. These partnerships - growing in number all the time - give us unrivaled access to premium targeting attribution criteria. Our industry-leading, network-aware mobile marketing platform supports more than 350 use cases that enhance brand engagement activities; including sponsored data, data rewards, sponsored mobile advertising and video, and BYOD split billing. Mobile operators benefit from the ability to scale their advertising, wholesale and B2B businesses, while increasing ARPU and accelerating monetization of new digital services.

Our unique ability to blend operator data, brand data, and proprietary technology allows us to drive a new level of brand engagement.

We are a group of mobile network, internet, and marketing experts that create mobile marketing solutions which enable brands to amplify their connection with mobile customers. We believe mobile data should be for everyone and we understand that, for mobile marketing to succeed, everyone has to benefit. Our solutions are designed to meet the needs of brands, advertising agencies and mobile operators, and most importantly, data-hungry mobile customers.

Datami is headquartered just outside bright and beautiful Boston and have teams across the globe, including our development center in Bangalore.

Sponsored Data can also be used to serve the greater good, by bridging digital inequalities that exclude 3.9 billion people worldwide from Internet access. Learn more about the Reach for All Impact Initiative.

Brands

Operators

Consumers

Enterprises

Increase

Clicks

Higher

Impressions

More

Installs

Broader

Reach

Higher

Transactions

Higher

Loyalty

More

Video Views

More

Purchases

Data

Rewards

Advertising

Split-billing

Billing

Targeting

Network BI

Analytics

Locker

Gateway

Portal

Portal

Cloud

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

Read more

- Leadership

- Board & Advisors

- Team

-

Harjot SalujaPresident and CEO

Harjot SalujaPresident and CEO -

Jagan ShantigramCTO

Jagan ShantigramCTO -

Harsh SaxenaCOO

Harsh SaxenaCOO -

Marcelo LeonSales Director, LATAM

Marcelo LeonSales Director, LATAM

-

Harjot Saluja

Harjot Saluja -

Jagan Shantigram

Jagan Shantigram -

Mung Chiang

Mung Chiang -

Jeff Samberg

Jeff Samberg -

Wim Sweldens

Wim Sweldens -

Marcus W. Brauchli

Marcus W. Brauchli -

John M. Cioffi

John M. Cioffi -

Brian O'Kelly

Brian O'Kelly

-

Dr. T. Russell Hsing

Dr. T. Russell Hsing -

Reed Hundt

Reed Hundt -

Bryan Rutberg

Bryan Rutberg -

Iyad Tarazi

Iyad Tarazi -

Strauss Zelnick

Strauss Zelnick -

Jake Mass

Jake Mass -

Donald H. Wang

Donald H. Wang -

Elizabeth Chambers

Elizabeth Chambers

-

Laurent Leboucher

Laurent Leboucher -

Harmeen Mehta

Harmeen Mehta

-

Abhilash Ramachandran

Abhilash Ramachandran -

Abhishek Agrawal

Abhishek Agrawal -

Abhishek Kumar

Abhishek Kumar -

Ajay Kumar Kayak

Ajay Kumar Kayak -

Ambika Pillai

Ambika Pillai -

Anil Kumar

Anil Kumar -

Arul Kumar

Arul Kumar -

Avi Chopra

Avi Chopra

-

Baba Saheb

Baba Saheb -

Cyan Herrara

Cyan Herrara -

Damandeep Singh

Damandeep Singh -

Devisetti Deekshitha Nageswara Rao

Devisetti Deekshitha Nageswara Rao -

Diwakar Bhardwaj

Diwakar Bhardwaj -

Harjot Saluja

Harjot Saluja

-

Harsh Saxena

Harsh Saxena -

Henrique Maria

Henrique Maria -

Jagan Shantigram

Jagan Shantigram -

Julia Metcalf

Julia Metcalf -

Julienne Pearson

Julienne Pearson -

Karthik M

Karthik M

-

Karthik R Pai

Karthik R Pai -

Krishna Mishra

Krishna Mishra -

Kuna. L. P. Hanuma

Kuna. L. P. Hanuma -

Marcelo Leon

Marcelo Leon -

Murari Janardhan

Murari Janardhan -

Pawan Bawankar

Pawan Bawankar

-

P Anand Kumar

P Anand Kumar -

Prateek Gupta

Prateek Gupta -

Raghu Muninanjappa

Raghu Muninanjappa -

Rajeev Mishra

Rajeev Mishra -

Ramkumar Chandrasekaran

Ramkumar Chandrasekaran

-

Ravikirana B S

Ravikirana B S -

Rich Gastwirt

Rich Gastwirt -

Rohit Mohan

Rohit Mohan -

Sameer Kumar Sahu

Sameer Kumar Sahu -

Sreeharsha S

Sreeharsha S -

Srinivasa Bapatla Veera

Srinivasa Bapatla Veera

-

Stephanie Walsh

Stephanie Walsh -

Sujith Kumar Aanand

Sujith Kumar Aanand -

Tej Bisht

Tej Bisht -

Thilagavathi Ramasamy

Thilagavathi Ramasamy -

Vikesh Kumar

Vikesh Kumar